Thinking Of Investing Into Stocks & Shares? Good!

This is a guest post by Ben Barlow, a Millennial investor, and digital marketer.

Are you hitting your thirties and finding yourself thinking about money more than ever before?

You are just like me.

For the first time, I have managed to save up some cash, which is aimlessly laying in my savings account for “rainy days” or “emergencies” and I’m thinking to invest half of it to grow it even further.

Millennials are known to be very conservative investors. They fear the stock market and prefer to keep their money in cash.

But cash won’t keep pace with inflation. It won’t grow by itself. Money as a currency is fluid, its value changes over time.

I’ve decided to start investing in high-growth startups that I personally believe in and I’m currently trying to discover undiscovered stocks on the market.

It’s a game, but in real life and it’s exciting.

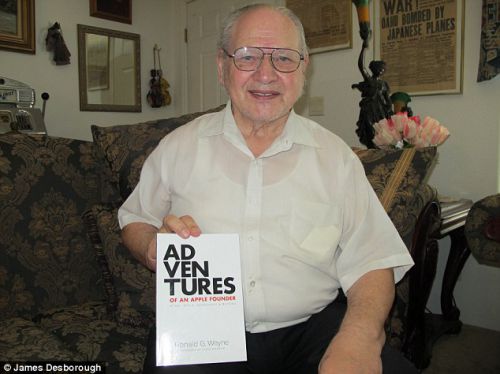

We’ve all read stories about how Apple shares worth of $800 in 1976 today are worth $35 billion. Or how people have made fortunes by investing in the right companies early. I’m sure these stories have made us all a little jealous or at least encouraged to try it for ourselves.

Ron Wayne, the forgotten founder of Apple, pictured with a copy of his autobiography.

Investing is not just for “important people”. You can do it, too! Everyone with any amount of cash, can invest in whatever they like.

Difference between stocks and shares?

That’s the tough one as not many seem to know the difference:

Stock is a general term used to describe the ownership certificates of any company.

If investors say they own stocks, they are generally referring to their overall portfolio – ownership in one or more companies.

You can buy and sell stock on a stock exchange and keep diversifying your portfolio.

Shares refer to the ownership certificates of a particular company.

Shareholders have usually (but not always) direct interest in the business. You might expect a shareholder to attend annual meetings, read annual reports, and approve or disapprove of the way the business is run.

Some of the options to look into

The financial marketplace is brimming with various investment options to choose from and it can be a bewildering task, wading your way through all the different rates of interest, terms and conditions.

IG Group Stocks and Shares ISA (trusted globally by millions since 1974) is a popular way to put your hard-earned money to work allowing you to invest up to £15,240 per year tax-free.

The tax advantages of Individual Savings Accounts (ISAs) makes them the smart way to save a regular monthly amount or invest a lump sum. Unlike a Cash ISA, a Stocks and Shares ISA lets you choose how your money is invested – giving you access to a wide range of investment opportunities.

The main benefit of a Stocks and Shares ISA is the choice. You can choose how your money is invested and there are two main options:

a) Managed funds are where the money you invest is used by professionals, the money is invested in the shares of a wide range of companies that have been floated on the stock market.

b) Investment trusts are similar to managed funds, but you become a shareholder in the investment company, this in itself can bring about extra benefits.

Whichever route you decide to follow, the return on your investment will be dictated by how well the companies you invest in perform in that particular year. The money you do make will not qualify for pay capital gains tax and so you get to keep every penny.

What to expect from a financial markets provider?

First of all, you want a user-friendly experience, a system that is easy to set up and that is flexible once you have invested your money.

Look out for providers that don’t charge transfer fees and that allow you to withdraw funds when you want to, without penalties.

In terms of which stocks and shares you decide to invest in, it is important that your provider gives you the ability to invest both domestically, that is to say in UK stocks and shares, and internationally.

Even if you have earmarked UK stocks and shares as a good initial investment, it’s always good to diversify further down the line, should you wish.

Is investing right for you?

It’s really not a question I can answer – it all depends on your personal circumstances and the amount of risk you’re willing to take.

But as a rule of thumb, you should invest for at least five years. This allows enough time to ride out any bumps in the market that might see you make a loss on your money.

It’s very important to understand that there’s no such thing as the best stocks & shares investment.

Over the long run, historically stocks & shares have outperformed money in savings accounts. But that’s no guarantee they’ll do so in the future.